Loanpal First

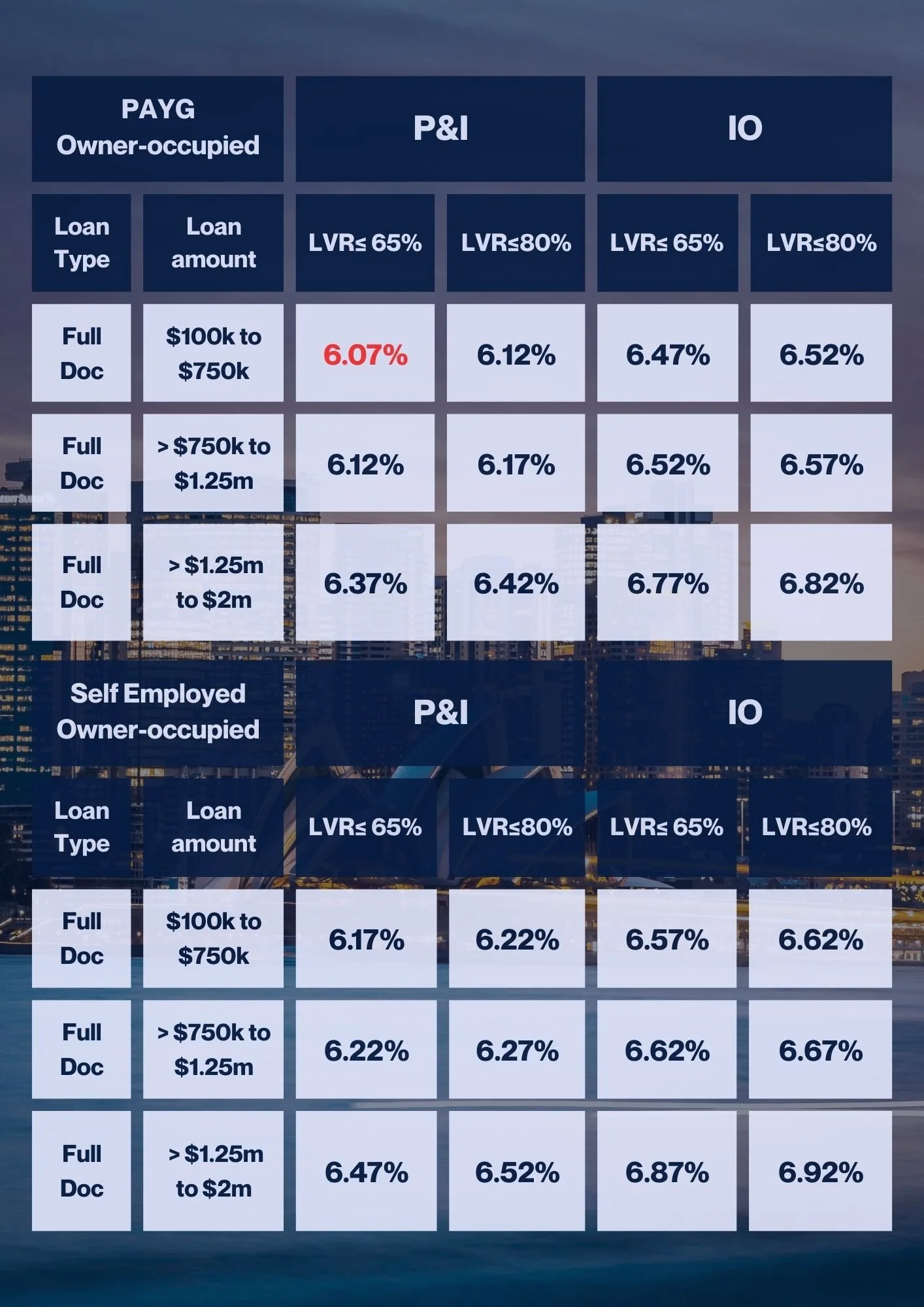

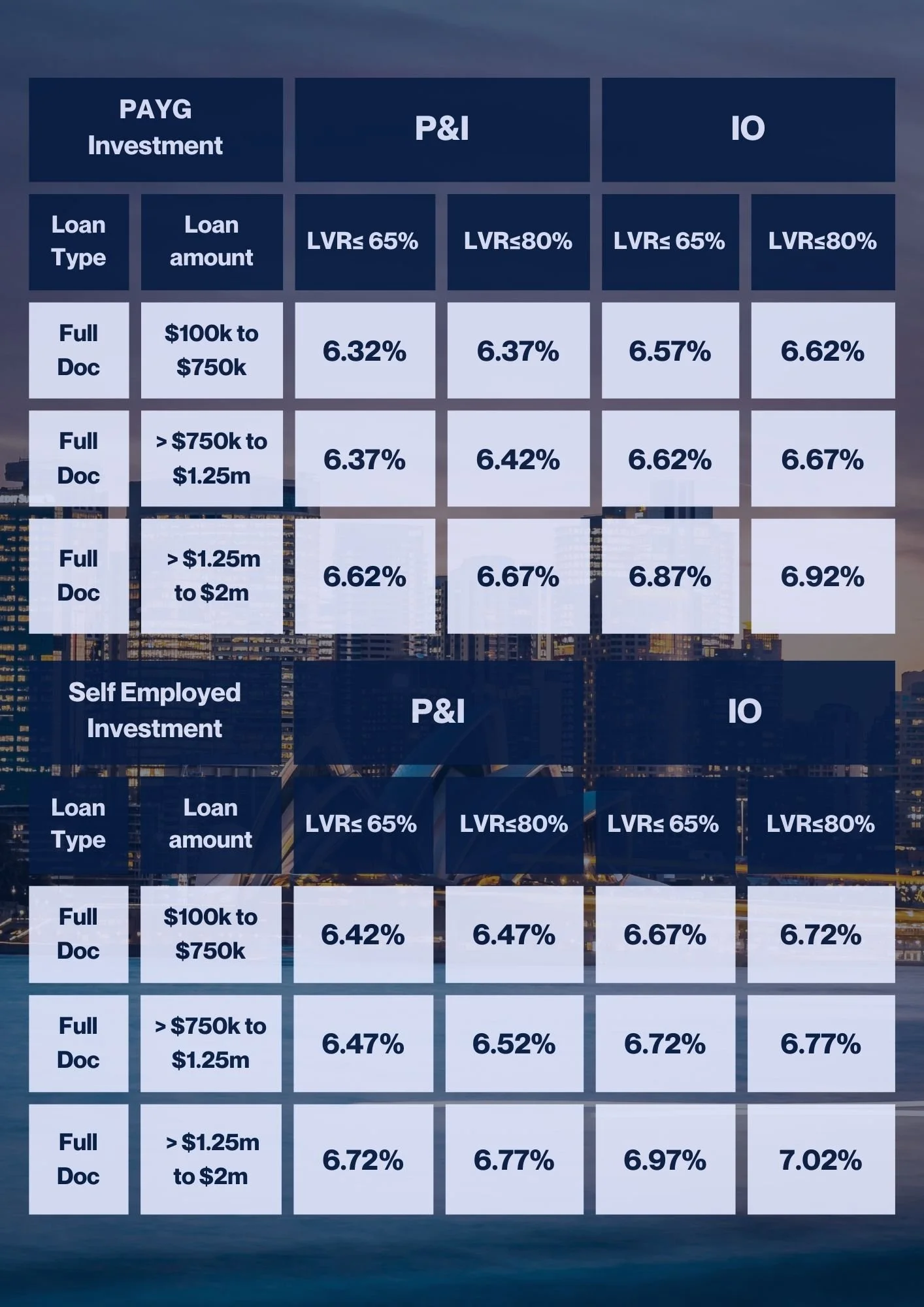

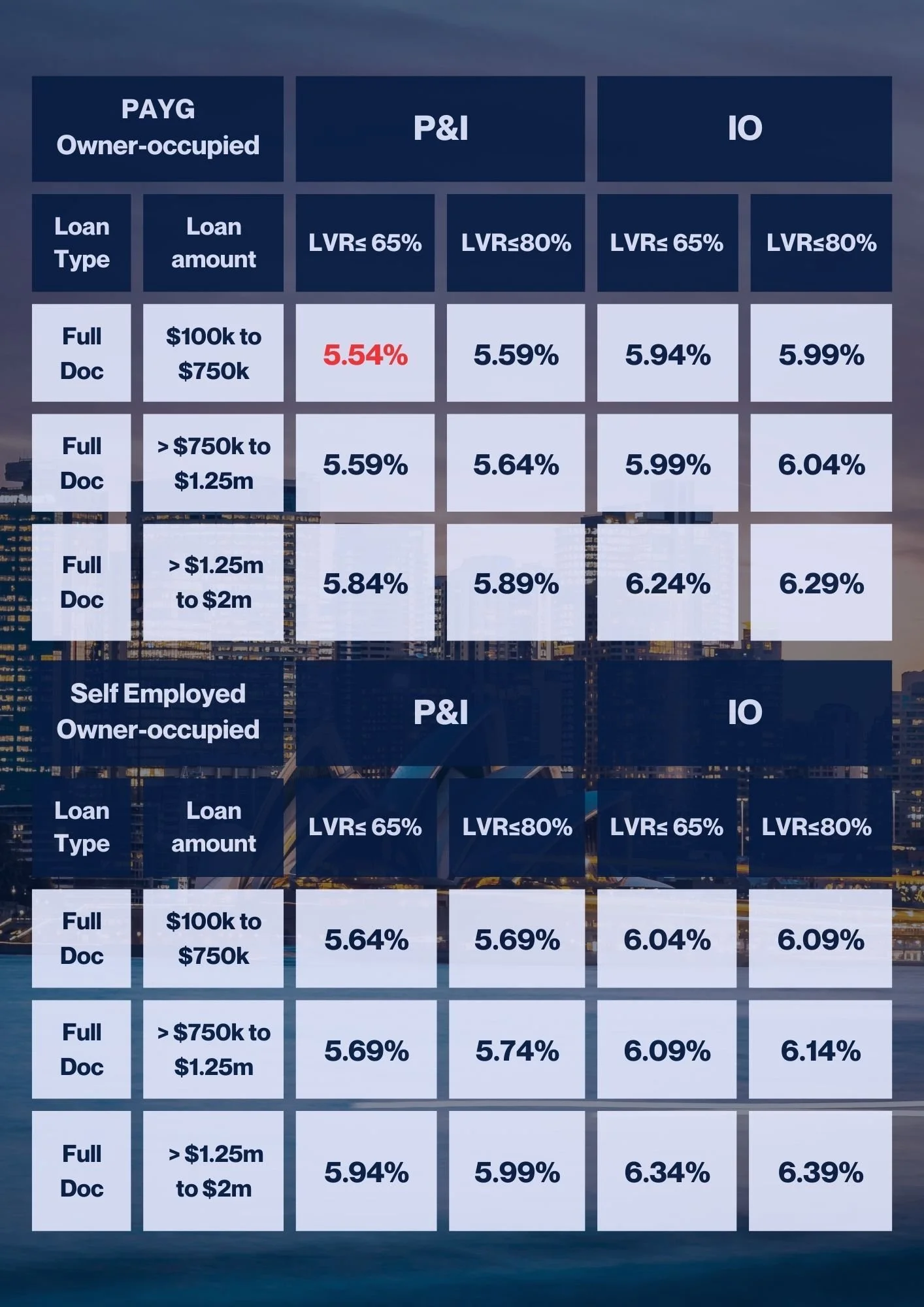

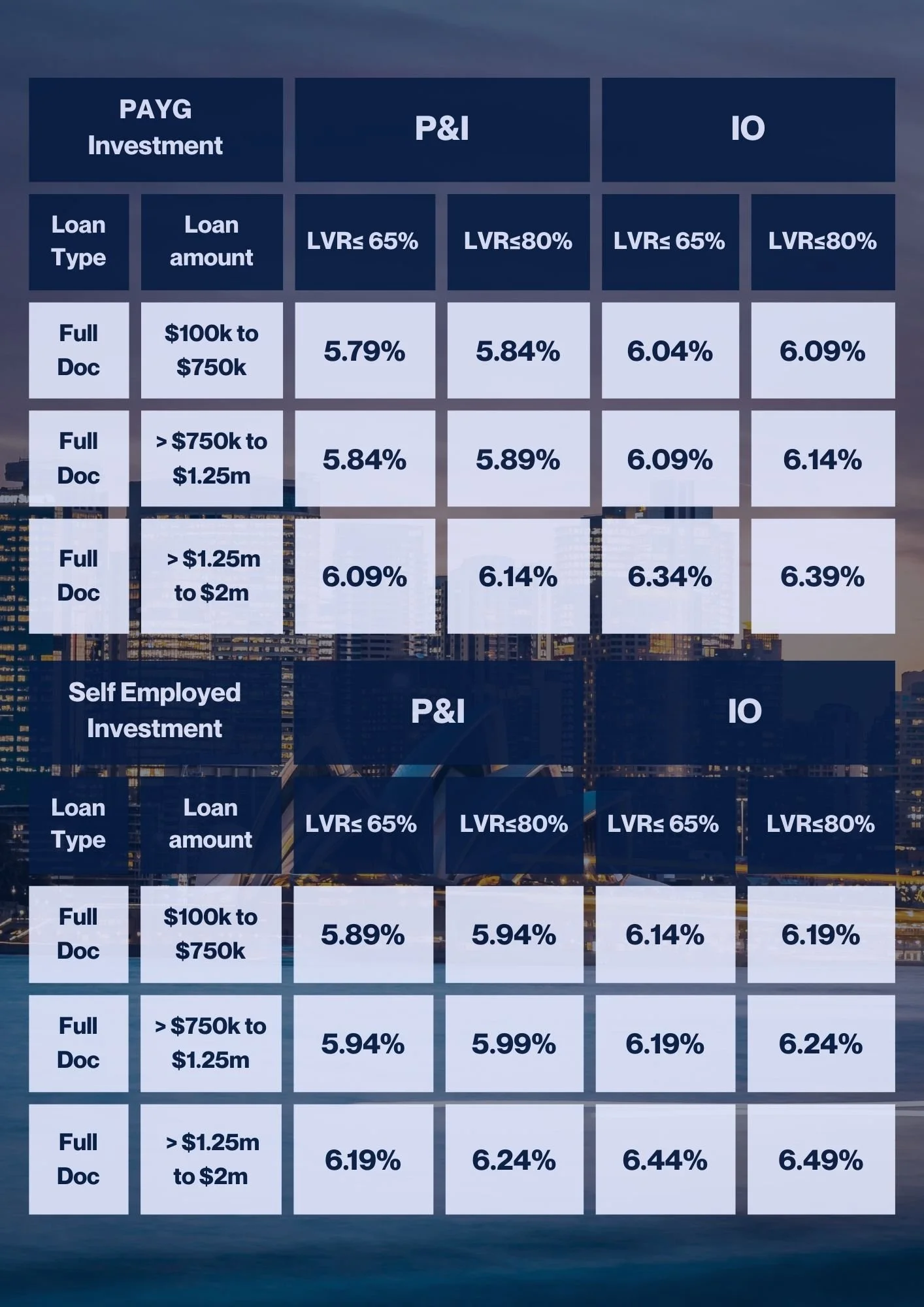

Borrower Rate from:

5.54% p.a.

Product Features:

Max Loan Amount: $2,000,000

LVR: 80%

Max Loan Term: 30 years

Max IO Term: 5 years

Negative Credit Reporting

Income Verification

-

Option 1: Latest Accountant prepared Company tax return and financial statements

Option 2: Latest Company financial statement with accountants’ declaration stating that the financials provided are final. (latest tax return or financial statement must be no older than 18 months)

-

A letter from accountant confirming business is trading profitably and meeting all its current liabilities including wages and is not in default of any financing arrangements

Plus One of the following:

1 current payslip showing more than three months YTD or

3 months of director’s wage salary credit or

ATO income statement with minimum 3 months history

-

ABN search confirming minimum of 18 months trading, latest personal tax return and one of the following:

Latest ATO Notice of Assessment; or

Written confirmation from accountant stating that the tax return provided is final; or

The previous years ATO Notice of Assessment

-

2 Payslips (Within 60 Days),

or Any 2 of the Folowing:

1 Payslip (Within 60 Days)

Employment Letter

Income Statement (Most Recent)

Fee & Charges

-

Application & Valuation Fee

Total Upfront Fee: $990

Includes valuation fee coverage up to $440

Please Note:

Valuation costs above $440 will be

advised before proceeding.

$550 application fee is refundable,

if the application is unsuccessful.

-

Solicitor Documentation Fee $385 or At-Cost

Annual Fee $180 Payable at Settlement & annually Thereafter

Settlement Fee $275 Payable at Settlement

Escalation Fee $350 Payable at Settlement

AVM Product Fee $49 Payable at Settlement

-

Product Discharge Fee from $695 Payable at Discharge

Processing Fee from $330

Eligible Borrowers:

Individuals

Company

Trust

Australian Temporary Visas with a primary borrower being an Australian permanent resident or citizen

(subject to acceptable VISA class)

Acceptable Visa Class

| Category | Temporary Visa |

|---|---|

| Skilled & Employer | Subclass 482 – Temporary Skill Shortage (TSS) |

| Skilled & Employer | Subclass 491 – Skilled Work Regional (Provisional) |

| Skilled & Employer | Subclass 494 – Skilled Employer Sponsored Regional (Provisional) |

| Skilled & Employer | Subclass 485 – Temporary Graduate |

| Skilled & Employer | Subclass 476 – Skilled Recognised Graduate |

| Family & Partner | Subclass 300 – Prospective Marriage |

| Family & Partner | Subclass 309 – Partner (Provisional, offshore) |

| Family & Partner | Subclass 820 – Partner (Temporary, onshore) |

| Family & Partner | Subclass 884 – Contributory Aged Parent (Temporary) |

| Business & Investment | Subclass 188 – Business Innovation & Investment (Provisional) |

| Special & Regional | Subclass 444 – Special Category (NZ Citizens) |

| Special & Regional | Subclass 408 – Temporary Activity |

| Closed/Replaced | Subclass 160–165 – Business Skills (Provisional) |

| Closed/Replaced | Subclass 457 – Temporary Work (Skilled) |

| Closed/Replaced | Subclass 487 – Skilled Regional Sponsored |

Security Location Guide

| State | Metro Postcodes | Non-Metro Postcodes |

|---|---|---|

| ACT | 2600–2617 2900–2920 |

0200–0799 |

| NSW |

1000–1920 2000–2005 2006–2308 2500–2534 2555–2574 2745–2786 |

1921–1999 2309–2499 2535–2554 2575–2599 2618–2744 2787–2899 2921–2999 |

| VIC |

3000–3010 3011–3232 3235 3240–3241 3321 3328–3340 3427–3441 3750–3815 3910–3920 3926–3944 3972–3978 3980–3983 |

3233–3234 3236–3239 3242–3320 3322–3327 3341–3426 3442–3749 3816–3909 3921–3925 3945–3971 3979 3984–3999 |

| QLD |

4000–4004 4005–4228 4270–4313 4340–4342 4346 4500–4575 |

4229–4269 4314–4339 4343–4345 4347–4499 4576–4999 |

| SA |

5000–5005 5006–5199 5800–5999 |

5200–5799 |

| WA |

6000–6004 6005–6214 6800–6999 |

6215–6799 |

| TAS |

7000–7003 7004–7199 7800–7899 |

7200–7799 7900–7999 |

| NT |

0800–0820 0828–0832 |

0821–0827 0833–0999 |